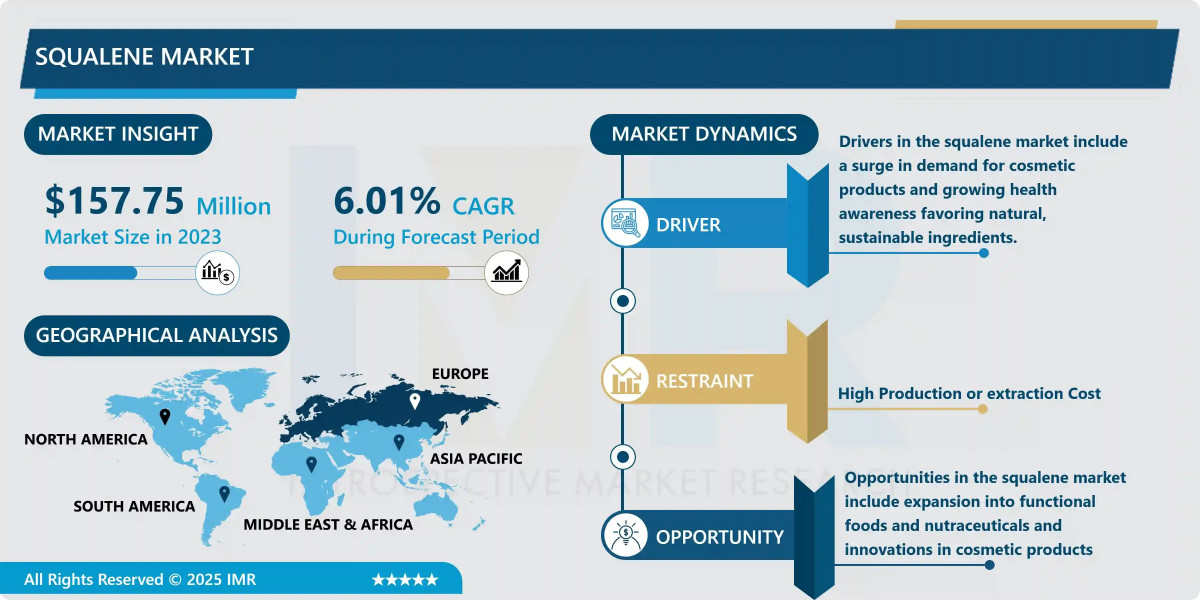

According to a new report published by Introspective Market Research, Squalene Market by Source, Application, and End-Use Industry, The Global Squalene Market Size Was Valued at USD 157.75 Million in 2023 and is Projected to Reach USD 266.74 Million by 2032, Growing at a CAGR of 6.01%.

Market Overview:

The Squalene Market is witnessing steady growth driven by increasing demand across cosmetics, pharmaceuticals, and nutraceutical industries. Squalene is a naturally occurring organic compound traditionally sourced from shark liver oil and increasingly derived from plant-based sources such as olives, amaranth, and sugarcane. It is widely valued for its antioxidant, moisturizing, and immune-boosting properties.

Growth Driver:

A key growth driver of the Squalene Market is the rising demand for natural and sustainable cosmetic ingredients. Consumers are increasingly seeking clean-label, plant-based, and cruelty-free beauty products. Squalene, particularly plant-derived variants, aligns with these preferences due to its natural moisturizing properties and skin compatibility. Additionally, the expanding global skincare market and growing awareness of anti-aging solutions are boosting product formulations that incorporate squalene. Regulatory encouragement for sustainable sourcing and ethical alternatives to shark-derived ingredients further supports the transition toward plant-based and biosynthetic squalene production.

Market Opportunity:

A major opportunity in the Squalene Market lies in the expansion of vaccine development and advanced pharmaceutical applications. Squalene is a critical component in vaccine adjuvants, enhancing immune response effectiveness. With ongoing investments in global immunization programs and preparedness for emerging infectious diseases, demand for high-purity squalene is expected to grow. Furthermore, advancements in biotechnology are enabling scalable biosynthetic production methods, reducing dependence on traditional sources. This innovation opens new opportunities for pharmaceutical-grade squalene while addressing sustainability concerns and expanding market accessibility.

The Squalene Market is segmented on the basis of Source, Application, and End-Use Industry.

Source

The Source segment is further classified into Animal-Based Squalene, Plant-Based Squalene, and Synthetic/Biosynthetic Squalene. Among these, the Plant-Based Squalene sub-segment accounted for the highest market share in 2023. The dominance of plant-based squalene is driven by growing consumer preference for vegan and cruelty-free products. Olive-derived squalene, in particular, is widely used due to its stability and skin-friendly properties. Sustainability concerns surrounding shark-derived squalene have significantly shifted demand toward renewable plant sources, encouraging manufacturers to invest in eco-friendly extraction and processing technologies.

Application

The Application segment is further classified into Cosmetics & Personal Care, Pharmaceuticals, and Nutraceuticals. Among these, the Cosmetics & Personal Care sub-segment accounted for the highest market share in 2023. Squalene is extensively used in moisturizers, serums, sunscreens, and anti-aging creams due to its excellent emollient and antioxidant characteristics. Its ability to mimic natural skin lipids enhances absorption and hydration, making it a preferred ingredient in premium skincare formulations. Rising disposable income and increasing beauty awareness globally further strengthen this segment’s market leadership.

Some of The Leading/Active Market Players Are-

- Kishimoto Special Liver Oil Co., Ltd. (Japan)

• Amyris, Inc. (USA)

• Croda International Plc (UK)

• Nucelis LLC (USA)

• Arbee Biomarine Extracts Pvt. Ltd. (India)

• Sophim (France)

• Evonik Industries AG (Germany)

• SeaDragon Marine Oils Limited (New Zealand)

• Cargill, Incorporated (USA)

• VESTAN (Spain)

• Maruha Nichiro Corporation (Japan)

• EFKO Group (Russia)

• Gracefruit Limited (UK)

and other active players.

Key Industry Developments

News 1:

In May 2024, a biotechnology company announced expanded production capacity for sugarcane-derived biosynthetic squalene to meet growing cosmetic and pharmaceutical demand.

The expansion focuses on sustainable fermentation-based processes, significantly reducing reliance on animal-derived sources. This development strengthens supply chain stability and supports the global shift toward environmentally responsible ingredient sourcing in personal care and healthcare industries.

News 2:

In October 2023, a major cosmetic ingredient manufacturer launched a high-purity plant-based squalene line targeting premium skincare brands.

The new product line emphasizes traceability, ethical sourcing, and improved oxidative stability. This initiative responds to rising consumer demand for clean-label beauty products and reinforces the company’s strategic positioning in the natural ingredients segment.

Key Findings of the Study

- Plant-Based Squalene dominates the source segment.

• Cosmetics & Personal Care leads application demand.

• North America and Europe are key revenue-generating regions.

• Growth driven by clean-label and vaccine applications.

• Biosynthetic production is an emerging market trend.