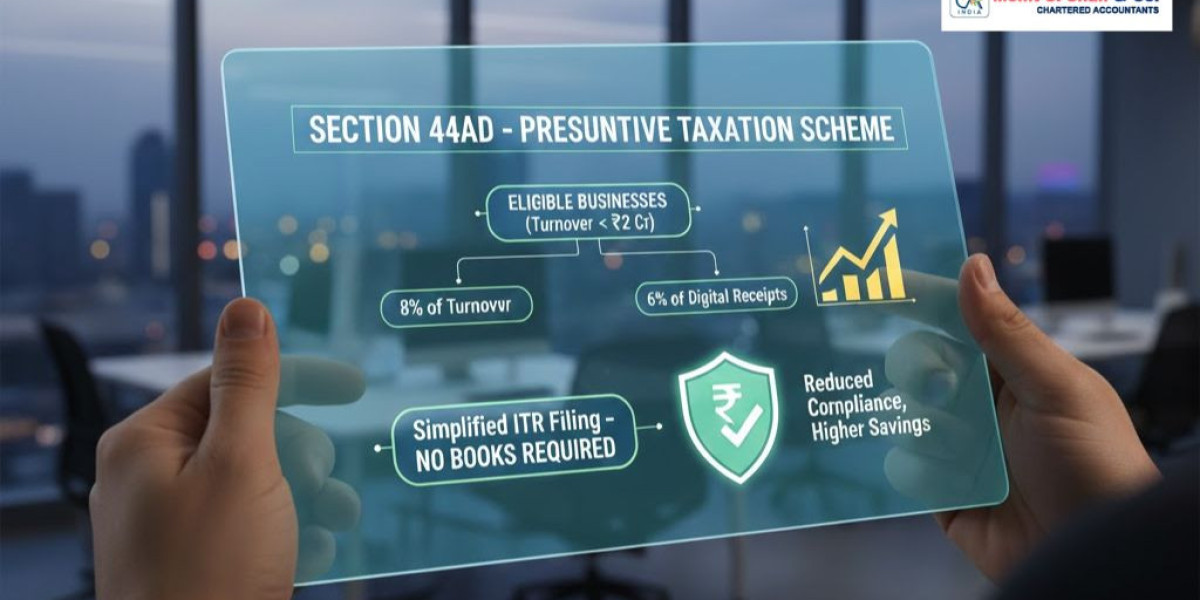

Section 44AD of the Income Tax Act, 1961 introduces the concept of presumptive taxation to reduce the compliance burden on small businesses in India. Under this scheme, eligible taxpayers are allowed to declare income at a prescribed rate instead of maintaining detailed books of accounts and undergoing tax audits.

The primary objective of Section 44AD presumptive taxation is to simplify income tax compliance while ensuring steady tax collection. This provision is particularly relevant for resident individuals, Hindu Undivided Families (HUFs), and partnership firms engaged in eligible businesses.

This article provides a comprehensive explanation of Section 44AD, its applicability, income computation, ITR filing requirements, benefits, and limitations, in an easy-to-understand manner.

What Is Section 44AD Presumptive Taxation

Section 44AD allows eligible taxpayers to presume a fixed percentage of their gross turnover or receipts as taxable income. Instead of calculating actual profits and expenses, income is deemed at a specified rate.

Under this scheme:

Income is presumed at 8% of total turnover for cash receipts

Income is presumed at 6% of turnover received through digital or banking modes

Once income is declared under Section 44AD, the taxpayer is not required to maintain detailed books of accounts as prescribed under Section 44AA.

Eligibility Criteria Under Section 44AD

To opt for Section 44AD presumptive taxation, the following conditions must be met:

The taxpayer must be a resident individual, resident HUF, or resident partnership firm (excluding LLPs)

The business turnover must not exceed ₹2 crore in a financial year

The business should not be engaged in professions specified under Section 44AA

The taxpayer should not claim deductions under Sections 10A, 10AA, 10B, 10BA, or Chapter VI-A (except Section 80CCD)

This scheme is designed specifically for small businesses operating within the prescribed turnover limit.

Businesses Not Covered Under Section 44AD

Certain businesses and professions are excluded from the applicability of Section 44AD, including:

Professionals such as doctors, lawyers, architects, accountants, and consultants

Commission-based businesses

Agency businesses

Businesses earning income from brokerage or commission

Such taxpayers must follow normal taxation provisions and maintain regular books of accounts.

Computation of Income Under Section 44AD

Income under Section 44AD is computed on a presumptive basis. The taxpayer declares income as a percentage of gross turnover rather than calculating actual profit.

For example:

If turnover is ₹50,00,000

Digital receipts are ₹40,00,000 → Income at 6% = ₹2,40,000

Cash receipts are ₹10,00,000 → Income at 8% = ₹80,000

Total presumptive income = ₹3,20,000

No further deduction for business expenses is allowed since expenses are presumed to be included in the deemed income.

ITR Filing for Small Businesses in India Under Section 44AD

Taxpayers opting for Section 44AD must file their income tax return using ITR-4 (Sugam). This return form is specifically designed for presumptive income taxpayers.

Key points regarding ITR filing for small businesses in India under Section 44AD include:

Filing is mandatory even if income is below the basic exemption limit

Advance tax must be paid in one installment by 15th March

No requirement of tax audit if presumptive income is declared as per prescribed rates

Timely ITR filing ensures compliance and avoids interest and penalties.

Continuity Requirement and Restrictions

Once a taxpayer opts for Section 44AD, they are required to continue with the scheme for five consecutive assessment years.

If the taxpayer:

Declares income lower than the prescribed rate, or

Opts out before completing five years

Then Section 44AD cannot be opted again for the next five assessment years, and tax audit provisions may apply.

This rule ensures consistency and prevents misuse of the presumptive taxation scheme.

Advantages of Section 44AD Presumptive Taxation

Section 44AD offers several compliance-related benefits:

Reduced record-keeping and documentation

No requirement for detailed books of accounts

Exemption from tax audit up to ₹2 crore turnover

Simplified tax calculation

Lower compliance cost for small businesses

These advantages make Section 44AD a preferred option for eligible small taxpayers seeking ease of compliance.

Limitations of Section 44AD

Despite its simplicity, Section 44AD has certain limitations:

No deduction for actual business expenses

Not suitable for businesses with low profit margins

Restriction on claiming losses

Mandatory continuity requirement for five years

Not applicable to professionals and LLPs

Taxpayers must evaluate whether presumptive taxation aligns with their actual financial position.

When Should Section 44AD Be Considered

Section 44AD is generally suitable when:

Business profits are equal to or higher than prescribed presumptive rates

Record-keeping is minimal

Compliance simplicity is preferred

Turnover is well within the ₹2 crore limit

Conversely, taxpayers with higher expenses or lower margins may find normal taxation more beneficial.

Role of Professional Guidance

Understanding the applicability and implications of Section 44AD requires careful evaluation of business turnover, profit margins, and long-term compliance impact. Firms like Mohit S. Shah & Co focus on explaining statutory provisions, compliance requirements, and procedural aspects in a structured and educational manner, enabling taxpayers to make informed decisions.

Conclusion

Section 44AD presumptive taxation is a significant compliance-relief provision aimed at small businesses in India. By allowing income declaration at prescribed rates, it simplifies tax computation and reduces administrative burden. However, the decision to opt for Section 44AD should be based on a thorough understanding of eligibility conditions, continuity requirements, and financial suitability.

Proper evaluation and accurate ITR filing for small businesses in India ensure compliance while avoiding unnecessary complications under the Income Tax Act.