Introduction

The Hemp Fiber Market involves the cultivation, processing, and commercialization of fibers extracted from the stalks of the Cannabis sativa plant, focusing on industrial (low-THC) hemp. These fibers are used across textiles, composites, paper, construction materials, animal bedding, insulation, and other sectors. Hemp fiber is prized for its strength, biodegradability, light weight, and lower environmental footprint relative to some synthetic alternatives.

This market is increasingly relevant worldwide as industries seek sustainable, biodegradable, and lower-carbon alternatives to conventional fibers and materials.

Learn how the Hemp Fiber Market is evolving—insights, trends, and opportunities await. Download report: https://www.databridgemarketresearch.com/reports/global-hemp-fiber-market

The Evolution of the Hemp Fiber Market

Historical Development

Hemp has been used for fiber production for millennia—traditional applications include ropes, sails, and coarse textiles. In many parts of the world, hemp cultivation was common until the 19th and 20th centuries, when synthetic fibers and regulatory restrictions on Cannabis curtailed its industrial use.

Late in the 20th century, renewed interest in sustainable and natural fibers, combined with advances in agricultural methods and regulation changes, began reviving hemp cultivation. Over the past two decades, lawmakers in several countries have gradually relaxed industrial hemp regulations, enabling commercial hemp fiber use.

Innovations and Milestones

Improved Decortication Techniques: Mechanized decorticators separate bast fiber from core with better efficiency and lower damage, increasing yield and reducing cost.

Automation & Processing Efficiency: Automated sorting, cleaning, and fiber refinement allow scaling operations.

Hybrid Composite Development: Incorporation of hemp fiber in polymer composites (e.g. in automotive panels) as a lightweight, natural reinforcement.

Regulatory Reforms: Several countries have reclassified industrial hemp to permit low-THC strains; that shift enables expansion of hemp fiber cultivation.

These innovations help shift hemp fiber from niche to more mainstream use across multiple industries.

Market Trends

Emerging Consumer & Industry Trends

“Sustainable Fashion”: Consumers increasingly demand eco-friendly materials; hemp offers a more sustainable alternative to cotton or synthetics.

Circular Economy & Biodegradability: Hemp fiber, being natural and biodegradable, aligns with circular economy goals and landfill reduction.

Green Building Materials: Hemp-based insulation, hempcrete, fiberboard, and composites are gaining adoption in sustainable construction.

Natural Composites in Automotive & Consumer Goods: Use of hemp fiber in dashboards, panels, packaging, and other components is increasing.

Technology Adoption & Advancements

Nanofibers & Micro processing: Refining hemp to nano- or microfibers to enhance strength, surface area, and compatibility in composites.

Fiber Blends & Hybrid Textiles: Blending hemp with cotton, bamboo, or synthetics to balance cost, comfort, and performance.

Advanced Treatments & Coatings: Surface treatments to improve moisture resistance, dyeability, and antimicrobial properties.

Smart Textiles & Sensor Integration: Embedding sensors or conductive elements into hemp-based fabrics for wearable tech.

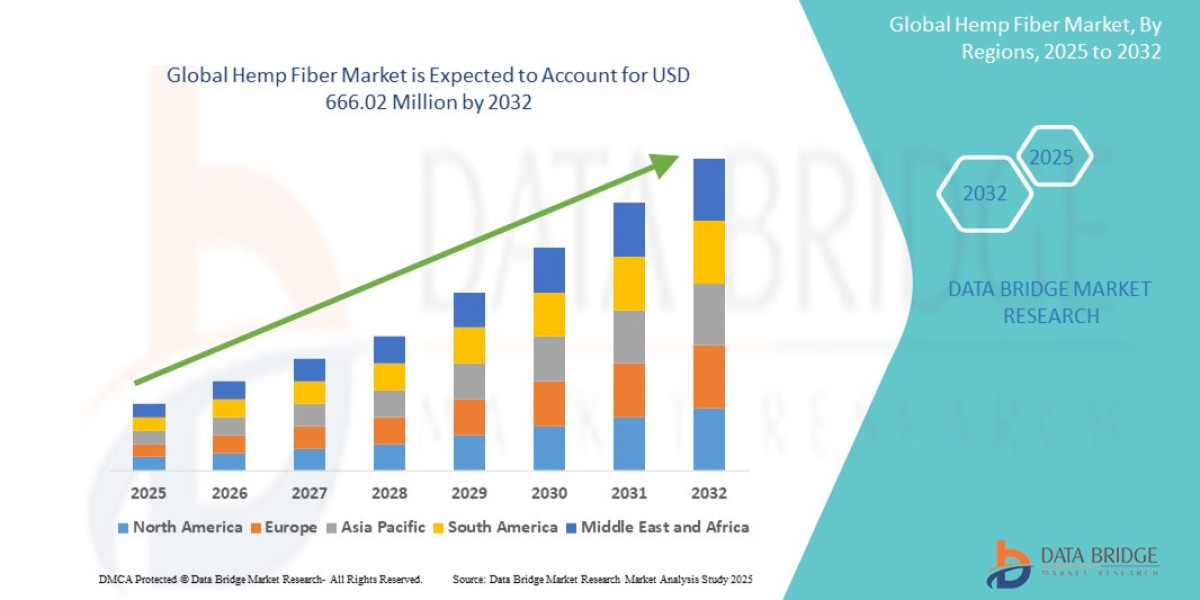

Regional & Global Adoption Patterns

Asia-Pacific: Leading region in hemp fiber adoption, particularly China and India, due to existing hemp cultivation infrastructure.

Europe: Strong regulatory support and sustainability policies boost hemp fiber use in textiles, construction, and composites.

North America: The U.S. and Canada are ramping up hemp cultivation and processing capacity under favorable legal changes.

Latin America, Middle East & Africa: Emerging markets, with potential for growth as regulation and infrastructure improve.

Challenges

Industry Challenges

Regulatory Complexity: Hemp cultivation still faces legal barriers in certain jurisdictions due to its association with cannabis.

Lack of Standardized Fiber Quality: Variation in cultivation, processing, and grading leads to inconsistent fiber properties.

High Processing Costs: Despite automation, processing and refining hemp fiber remain costlier than mature synthetic fiber systems.

Supply Chain & Logistics: Hemp fiber processing facilities are concentrated; transporting bulky raw biomass is costly.

Key Barriers to Growth

Public Perception & Misconceptions: Confusion between industrial hemp and psychoactive cannabis can impede acceptance.

Competing Materials: Synthetics, cotton, jute, flax, and other natural fibers compete on cost and availability.

Access to Capital: High capital investment needed for fiber processing plants and equipment discourages small players.

Scaling Limitations: Scaling cultivation, harvesting logistics, and processing capacity to meet large industrial demand is nontrivial.

Risks the Market Faces

Regulatory Reversal: Changes in legislation could limit or restrict hemp cultivation again.

Market Saturation or Correction: Overinvestment could lead to oversupply and price crashes.

Technological Obsolescence: Rapid advances might render current processing technologies outdated.

Climate & Crop Risk: Hemp is an agricultural crop subject to weather, pests, and variable yields.

Market Scope & Segmentation

Segmentation by Type

Long (Bast) Fibers: Strong outer fibers used for textiles, ropes, ropes, composites.

Short (Core) Fibers: Softer inner fibers used for insulation, pulp & paper, animal bedding, bio-composites.

Segmentation by Source / Cultivation Method

Conventional Hemp

Organic Hemp

Segmentation by Application / Use Case

Textiles & Apparel

Pulp & Paper

Composite Materials (automotive, packaging, consumer goods)

Insulation & Building Materials

Animal Bedding

Bio-Polymer / Bioplastics

Others (e.g. technical fabrics, filters, geotextiles)

Regional Analysis

North America

Europe

Asia-Pacific

Latin America

Middle East & Africa

End-User Industries

Textile & Apparel Manufacturers

Construction & Building Materials Firms

Automotive & Transportation OEMs

Pulp & Paper Industry

Consumer Goods & Packaging

Agricultural & Animal Husbandry

Market Size & Factors Driving Growth

- The global hemp fiber market size was valued at USD 390.54 million in 2024 and is expected to reach USD 666.02 million by 2032, at a CAGR of 6.90% during the forecast period

Increasing Legalization & Supportive Policies: As more countries permit industrial hemp cultivation, supply expands.

Sustainability Imperatives: Industries seek materials with lower carbon footprints and better end-of-life profiles.

Textile & Fashion Shift: Brands are incorporating hemp into clothing, accessories, and home textiles.

Growth in Natural Composites: Demand in automotive and consumer goods for lighter, bio-based composites.

Construction & Green Building: Use of hemp-based insulation, hempcrete, fiberboards in eco-conscious building.

Innovation in Processing & Fiber Quality: Better treatments, refining, and blending increase utility and competitiveness.

Opportunities in Emerging Regions

Asia-Pacific: Strong hemp cultivation base (China, India), rising textile and manufacturing capacity.

Africa & Latin America: Potential expansion as regulatory and infrastructure improve.

Europe’s Green Focus: European Union’s push for circular economy and sustainable materials can favor hemp.

North America: Expanded U.S. hemp acreage and investments in fiber processing can drive scale.

Conclusion

The hemp fiber market is at a pivotal growth phase. Supported by legalization trends, sustainability drivers, and cross-industry demand, the global market is projected to grow robustly over the next decade. While forecasts differ widely—from a few billion to tens of billions—the consensus is a high-growth trajectory.

To win in this space, stakeholders should focus on:

Developing scalable and cost-efficient processing infrastructure

Standardizing fiber quality and grading frameworks

Innovating in composites, textile blends, and treatments

Expanding presence in emerging geographies

Monitoring regulatory and public perception trends

With deliberate strategies and continued innovation, hemp fiber can transition from niche to mainstream across sectors like textiles, construction, composites, and packaging.

Frequently Asked Questions (FAQ)

1. What exactly is hemp fiber?

Hemp fiber is natural fiber extracted from the stalk of industrial hemp (low-THC Cannabis sativa). The stalk comprises outer bast fibers (strong, long) and inner core fibers (shorter, softer), both used in various applications.

2. How large is the hemp fiber market currently?

Estimates vary. The Business Research Company reports USD 15.18 billion in 2024 . Other sources suggest smaller numbers (hundreds of millions) depending on scope.

3. What CAGR is expected for the hemp fiber market?

Forecasts typically range between ~22 % and ~35 % over the next 5–10 years, depending on application scope and regulatory assumptions.

4. Which regions lead in hemp fiber adoption?

Asia-Pacific leads currently, followed by Europe and North America. Emerging regions like Latin America and Africa hold future potential as regulation and infrastructure evolve.

5. What are the main applications of hemp fiber?

Applications include textiles, composites (automotive, packaging), insulation and building materials, pulp & paper, animal bedding, and biodegradable materials.

6. What are the primary challenges the market faces?

Key challenges are regulatory restrictions, inconsistent fiber quality, high processing costs, supply chain bottlenecks, and competition from alternative materials.

7. How can companies succeed in the hemp fiber market?

Success factors include investment in efficient processing, establishing quality standards, building integrated supply chains, focusing on high-margin applications, and expanding presence in emerging markets.

Browse More Reports:

Global Wire Rope Sling Market

Global Women's mHealth Market

Middle East and Africa Adenomyosis Drugs Market

North America Adenomyosis Drugs Market

Asia-Pacific Adenomyosis Drugs Market

Europe Adenomyosis Drugs Market

North America Ataxia Market

Asia-Pacific Ataxia Market

Europe Ataxia Market

Middle East and Africa Ataxia Market

Europe Bakeware Market

Middle East and Africa Bakeware Market

North America Bakeware Market

Asia-Pacific Bakeware Market

Asia-Pacific Benign Prostatic Hyperplasia Devices Market

About Data Bridge Market Research:

An absolute way to forecast what the future holds is to comprehend the trend today!

Data Bridge Market Research set forth itself as an unconventional and neoteric market research and consulting firm with an unparalleled level of resilience and integrated approaches. We are determined to unearth the best market opportunities and foster efficient information for your business to thrive in the market. Data Bridge endeavors to provide appropriate solutions to the complex business challenges and initiates an effortless decision-making process. Data Bridge is an aftermath of sheer wisdom and experience which was formulated and framed in the year 2015 in Pune.

Contact Us:

Data Bridge Market Research

US: +1 614 591 3140

UK: +44 845 154 9652

APAC : +653 1251 975

Email:- corporatesales@databridgemarketresearch.com